Working Capital Loans

The working capital loans for SMEs are applicable to SMES that need to make up the short-term fund shortage so as to guarantee the normal operating turnover, or have the demands for regular capital turnover occupation and initial working capital.

Small-sum Guaranteed Loan for SMEs

Small-sum Guaranteed Loan for SMEs

1. Product Introduction

The small-sum guaranteed loan is our first exclusive financing product for SMES, available for application in the name of the businesses or the business owners. It adopts the real-estate mortgage, financial assets pledge and the warrandice from financing guarantee institutions, aiming to meet the short-term financing needs of SMES in the daily production and operation.

2. Targeted Clients

SMES, SMES owners as well as individual businesses with the demands for the short-term working capital.

3. Product Features

A wide range of prospective borrowers, efficient and convenient processes, diversified capital channels, the recycled use of loan limit within 5 years.

4. Loan Limit and Maturity

The maximum loan limit is RMB 10 million and the longest maturity shall be 1 year.

Revolving Credit for Small Enterprises

Revolving Credit for Small Enterprises

1、Product Introduction

The revolving credit for small businesses are working capital loans for small businesses with the stable production and operation, adequate repayment sources and effective guarantees to meet the needs of the working capital loans for short-term production and operation.

2、Targeted Clients

SMES that need to make up the short-term fund shortage so as to guarantee the normal operating turnover, or have the demands for regular capital turnover occupation and initial working capital.

3、Product Features

Simple and convenient application, strong applicability and the recycled use of loan limit.

4、Loan Limit and Maturity

The maximum loan limit is RMB 30 million and the longest maturity shall be 1-3 years.

Loans for Fixed Assets Acquisition, Construction and Management

The loans for Fixed Assets Acquisition, Construction and Management are for SMES with the medium and long-term financing needs of purchasing or constructing commercial buildings and factories, purchasing machinery and equipment, as well as decorating, renovating or maintaining business-oriented property. It mainly includes the Loans for Fixed Assets Acquisition, Construction and Management of SMES, and the Business-Oriented Property Loans for Small Businesses.

Loans for Fixed Assets Acquisition, Construction and Management of SMES

Loans for Fixed Assets Acquisition, Construction and Management of SMES

1、Product Introduction

The Loans for Fixed Assets Acquisition, Construction and Management are a financing service for SMES in purchasing or constructing commercial buildings and factories, or the debt capital replaced by purchasing machinery and equipment.

2、Targeted Clients

SMES with the demands for all kinds of fixed assets acquisition and construction.

3、Product Features

Large loan amount, high loan-to-value ratio, long maturity and flexible mode of repayment.

4、Loan Limit and Maturity

The maximum loan limit is RMB 30 million and the longest maturity shall be 10 years.

Business-Oriented Property Loans for Small Enterprises

Business-Oriented Property Loans for Small Enterprises

1、Product Introduction

The Business-Oriented Property Loans for Small Enterprises are designed for small enterprises with the needs of decorating, renovating or maintaining business-oriented property, or replaced by purchasing, renovating or decorating business-oriented property.

2、Targeted Clients

SMES that have a sustained and stable settlement business or rent any business-oriented property in ICBC.

3、Product Features

Long maturity, large loan amount and flexible mode of repayment.

4、Loan Limit and Maturity

The maximum loan limit is RMB 30 million and the longest maturity shall be 10 year.

Special Loans for SMES

Online Loans for SMES

1、Product Introduction

The Online Loans for SMES are an online self-service revolving loan service issued by ICBC for legal persons of SMES and natural persons engaged in the production and operation with qualified mortgage (pledge) guarantees. Customers only need to sign a loan contract of revolving loan at one time. Within the validity period stipulated in the contract, customers can apply for withdrawal and repayment business under the contract through the online self-service bank. The system would process automatically and the capital would arrive in real time.

2、Targeted Clients

Legal persons of SMES and natural persons engaged in the production and operation with qualified mortgage (pledge) guarantees as well as the reasonable capital needs of production and operation. And the businesses that have high operating frequency for the capital in a short term without a limited maturity and space in particular.

3、Product Features

(1)Large loan amount and guaranteed withdrawal

(2)Self-service and convenient to save time and energy

(3)Flexible maturity to save money and time

4、Loan Limit and Maturity

The maximum loan limit is RMB 30 million and the contract can be signed for 2 years.

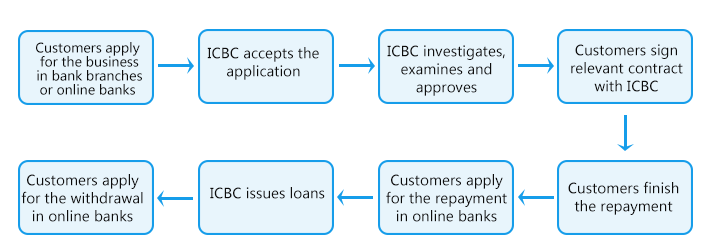

5、Handling Procedures

Loans for Science and Technology Businesses

According to the financing needs of science and technology businesses, ICBC provides the working capital loans, such as science and technology performance loans, loans for “professional, sophisticated, unique and innovative” businesses and SHIVC loans, with flexible guaranty styles including mortgage, pledge and credit enhancement.

Science and Technology Performance Loans

Science and Technology Performance Loans

1、Product Introduction

Our bank cooperates with Shanghai Technology Innovation Center and guarantee companies to provide RMB credit loans by means of risk sharing for science and technology businesses with good credit to meet the capital demands for the normal production and operation.

2、Targeted Clients

Small and micro science and technology businesses with the short-term demand for working capital loans.

3、Product Features

The cooperation between our bank and governmental unit, credit methods, preferential rate and flexible limit.

4、Loan Limit and Maturity

The maximum loan limit is RMB 5 million and the longest maturity shall be 1 year.

Loans for “Professional, Sophisticated, Unique and Innovative” Businesses

Loans for “Professional, Sophisticated, Unique and Innovative” Businesses

1、Product Introduction

Our bank cooperates with Shanghai Municipal Commission of Economy and Information Tehnology, Shanghai SME Development Coordination Office and Shanghai SME Policy Guarantee Fund to offer loans to the “professional, sophisticated, unique and innovative” businesses with good credit to meet the capital demands for the normal production and operation. And Shanghai SME Policy Guarantee Fund provides guaranty styles.

2、Targeted Clients

The “professional, sophisticated, unique and innovative” businesses with the short-term demands for working capital loans.

3、Product Features

The cooperation between the bank and governmental units, Green Channel, convenient processes and preferential rate.

4、Loan Limit and Maturity

The maximum loan limit is RMB 10 million and the longest maturity shall be 1 year.

SHIVC Loans

SHIVC Loans

1、Product Introduction

Our bank cooperates with SHIVC and Shanghai SME Policy Guarantee Fund to offer loads to the superior science and technology SMES recommended by SHIVC to meet the capital demands for the normal production and operation. And Shanghai SME Policy Guarantee Fund provides guaranty styles.

2、Targeted Clients

The superior science and technology SMES recommended by SHIVC with the short-term demands for working capital loans.

3、Product Features

The combination with investment and loan, convenient processes and preferential rate.

4、Loan Limit and Maturity

The maximum loan limit is RMB 5 million and the longest maturity shall be 1 year.